The billing statement is the report of the monthly transactions of the credit cardholder. And credit card companies issue these cards to the card owners. It shows their monthly transactions, the payment due information, and the other vital information. The companies issue the statement at the end of every billing cycle. Nowadays, credit cardholders receive the billing statements through mail or online. The billing statement templates holds the information on the expenses and transactions you did while shopping and paying bills.

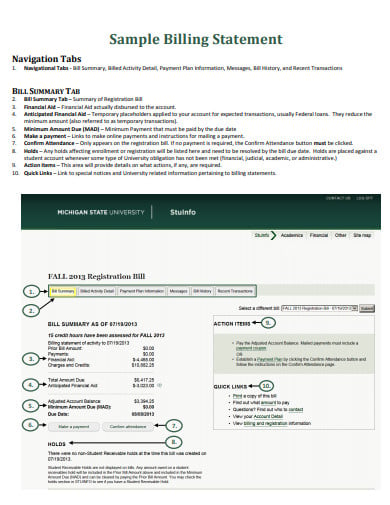

ctlr.msu.edu

File Format

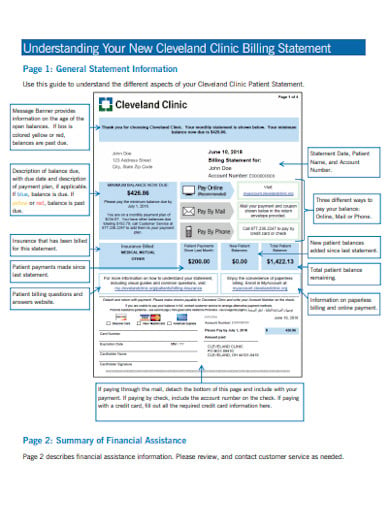

my.clevelandclinic.org

File Format

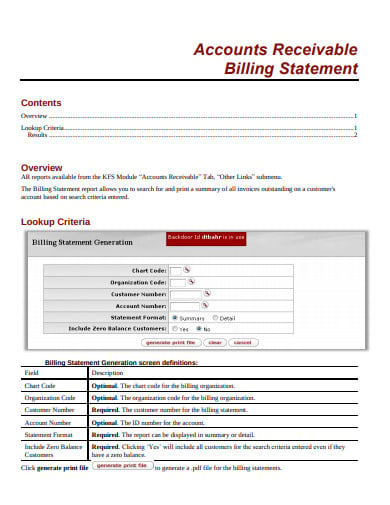

fms.iu.edu

File Format

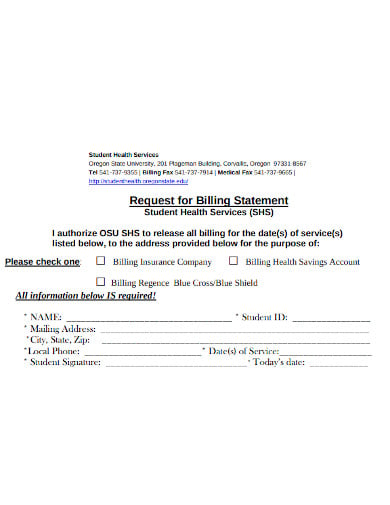

studenthealth.oregonstate.edu

File Format

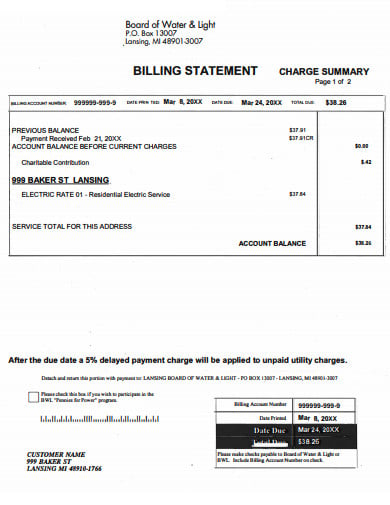

lbwl.com

File Format

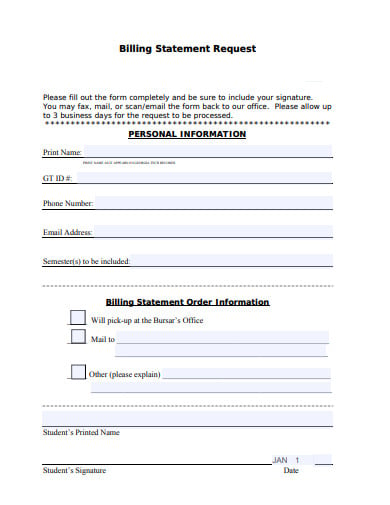

bursar.gatech.edu

File Format credit billing statement rights" width="390" height="505" />

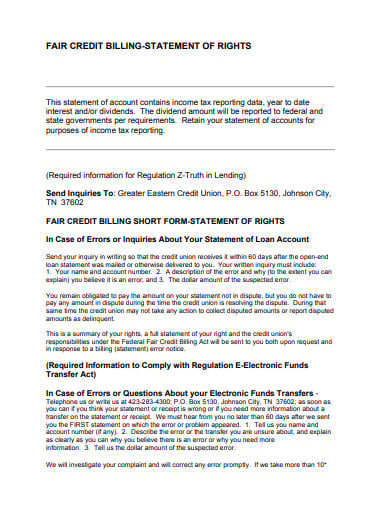

credit billing statement rights" width="390" height="505" />

greatereastern.org

File Format

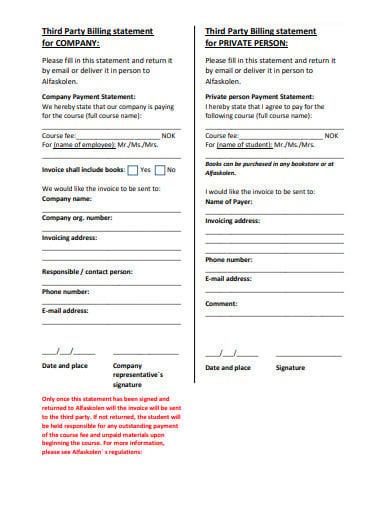

alfaskolen.no

File Format

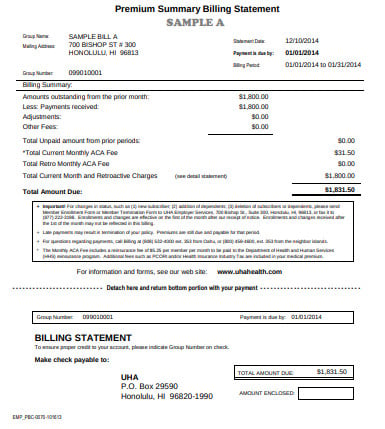

uhahealth.com

File Format

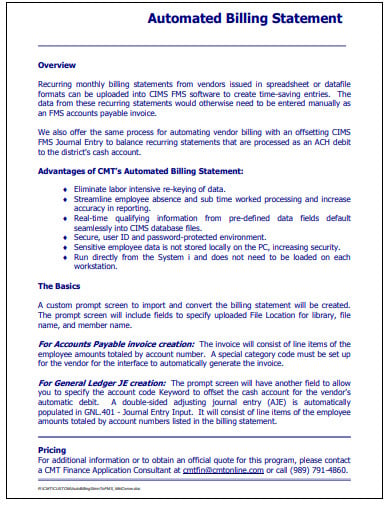

cmtonline.com

File Format

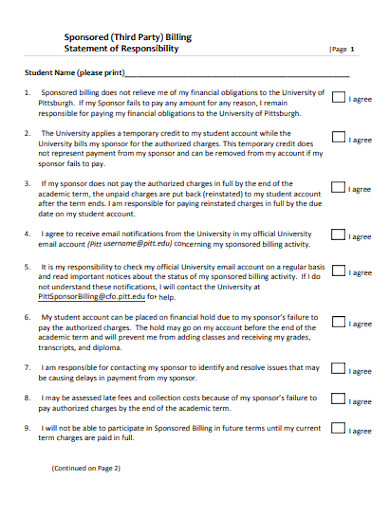

payments.pitt.edu

File Format

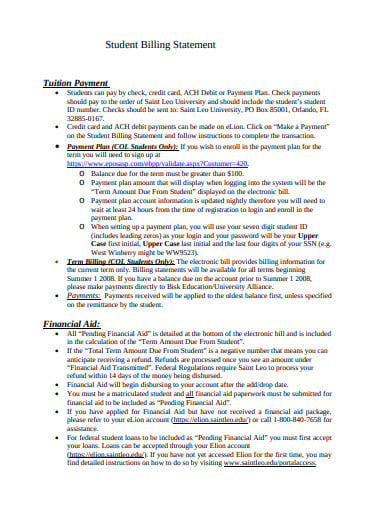

uts.saintleo.edu

File Format

zurichna.com

File Format

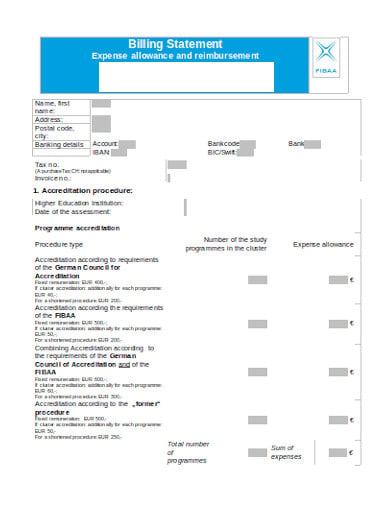

fibaa.org

File Format

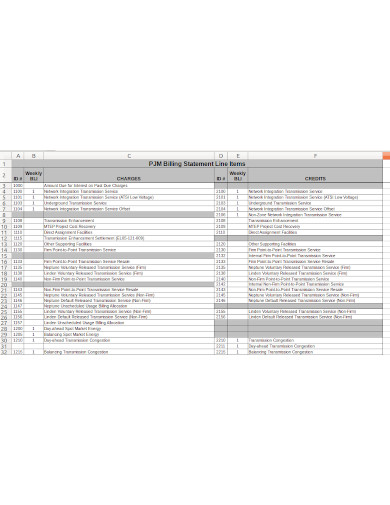

pjm.com

File FormatThere are different sections in the credit card billing statement. One section shows the user’s prior balance, the due payments, and credits. The statement contains the bank transfers, cash advance, the fee charged and new balance, etc.

In the billing statement, you must add the card holder’s information. The account details like the cardholder’s total credit limit. It gives information about the total amount spent and the amount available.

Then, you must add the transaction detail in the billing statement of the credit card. The transaction detail like the payment in various outlets or payment of bills using the credit card. The transaction detail of the user mentioned in the statement of the credit card.

You add the benefits section for the reward user of the credit card. So, that they can avail of the rewards and promotions from it. This section of the billing statement always creates interest among the people.

Then the billing statement must show any kind of deductions or interest added. The credit issuer issues the interest and other added fees in the balance statement. And this deduction will occur from the

The billing statement is an important piece of communication. And it provides the borrower with a certain monthly payment to keep their accounts active. It has the other necessary information like the transactions that took place in a month. It has the details of interest charged in a month, any late payment fee added by the credit issuer. The borrower has to pay the entire closing statement balance. There is the benefits section in the billing statement for the reward cardholders.

This section shows the reward and the offers gained by the user and they can use it under conditions. It discloses all types of deductions and fees charged on it. You can keep the statements as it is the records that you can show during the yearly accounting. You must keep the billing statements of every month safely with you because sometimes there can be confusion with the accounts. Then, you can use it to sort the confusion with the credit card company. Therefore, the billing statement is important to use in keeping records by both the user and the company.

The credit card billing statement utilizes a certain portion for the disclosure of the transactions. The credit card company issue the itemized summary of the interest rate charged at the beginning of the transaction. And the user needs this information for the tax issues. The account transaction section shows any kind of fees charged during the billing process. The transaction information all the details regarding the charge including the transaction date, post date, the trader’s name, and the transaction fee. It also shows how the card issuer calculates the interest.